Reports suggest that the Conservative party will make scrapping Inheritance Tax (IHT) part of its manifesto pledge in a bid to secure the general election. Frozen tax thresholds meant HMRC raked in a record amount of IHT in the last tax year. Read on to find out more about the reports.

While there have been reports that IHT would be abolished next year, according to the Guardian, it’s something prime minister Rishi Sunak is considering as a manifesto pledge.

The controversial tax could help boost election votes, as more estates are paying IHT due to frozen thresholds.

In 2023/24, the nil-rate band is £325,000. If the total value of your estate is below this threshold, no IHT is due. In addition, if you leave your main home to direct descendants, you may also be able to use the residence nil-rate band, which is £175,000 in 2023/24.

The government has frozen both the nil-rate band and the residence nil-rate band until April 2028.

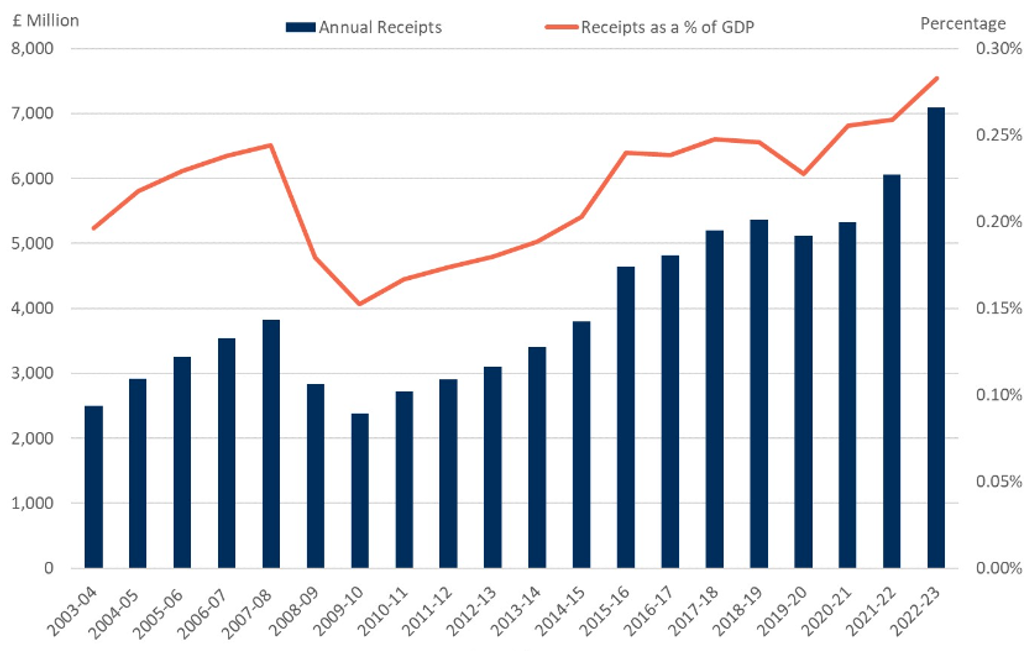

HMRC data shows the government collected a record amount through IHT in 2022/23. In total, families paid £7.1 billion in IHT last tax year. HMRC said the rise was likely due to a combination of “recent rises in asset values and the government’s decision to maintain the IHT nil-rate band thresholds”.

The graph below shows how IHT receipts have climbed over the last 20 years:

Source: HMRC

Scrapping IHT may seem contradictory following reports that Sunak’s priority is reducing high inflation over tax cuts.

However, while £7.1 billion in IHT may seem substantial, it accounts for just 0.28% of GDP. So, the government may view scrapping IHT as a way to boost election-day votes without having a significant effect on its coffers.

For some people, abolishing IHT could affect their estate plan. For instance, if you’ve decided to gift assets during your lifetime to reduce a potential IHT bill, you may want to review this decision if the plans went ahead.

There are calls for an Inheritance Tax overhaul rather than abolishing it

While some have welcomed reports that the government could scrap IHT, others are urging for an overhaul to make the tax “fairer”. There are several ways Sunak could change IHT.

Reduce the Inheritance Tax rate

The portion of your estate that exceeds the IHT thresholds is currently taxed at a standard rate of 40%. One option that might still deliver an election boost is to slash the tax rate to reduce the bills estates are paying.

Increase the Inheritance Tax thresholds in line with inflation

As mentioned above, the nil-rate band and residence nil-rate band have both remained the same for several years and are frozen until 2028. Reversing this decision and increasing the thresholds in line with inflation would mean fewer families will need to consider how to manage IHT.

Changes to gifting rules and other allowances

Alternatively, Sunak could change gifting allowances and other rules that estates may use to mitigate a potential tax bill when estate planning.

According to the Guardian, Paul Johnson, the director of the Institute for Fiscal Studies, said current IHT rules were “genuinely unfair”.

He added a report shows the “effective rate of IHT on estates of more than £10 million was only half the effective rate on estates of £2 million” as the tax is more difficult to avoid if a large portion of your wealth is your family home.

Don’t adjust your estate plan until changes are confirmed

While it can be tempting to try and get ahead of the curve by responding to the reports now, the potential changes aren’t set in stone. The government could alter its plans for IHT or decide to make no changes at all.

For most people, sticking to your existing estate plan and carrying out regular reviews makes sense. If the government announces changes, give yourself time to understand them and what they could mean for you and your beneficiaries before you react.

As financial planners, we can work with you to create an estate plan and ensure it continues to reflect current regulations. Please contact us to arrange a meeting to talk about your estate and wishes.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning or Inheritance Tax planning.