When saving into a pension, reaching £1 million can seem like an impossible challenge. But the magic of compounding can mean it’s easier to reach than you might think, especially if you start saving while young.

Compounding means that the returns earned from investments are reinvested. This means they go on to generate returns of their own. Over time, this can help savings to grow faster. As pensions are usually invested for decades, compounding plays a critical role in how your retirement savings grow over time. Even small, regular contributions can help you build a sizeable nest egg thanks to compounding.

Turning £1.71 a day into a £1 million pot

According to FT Adviser, an 18-year-old that starts their working life by putting £1.71 a day into a pension could be on track to enjoy a £1 million retirement.

While £1 million might seem unachievable, putting £1.71 into a pension each day can seem far more manageable. By the time you reach 68, you’d have made contributions for 50 years, totalling £31,207.59 – a figure still some way off the £1 million target. The key to reaching that goal is long-term investing and benefiting from the compounding effect over five decades.

To reach the £1 million goal the calculation assumes a high growth rate of 10%. This is the long-term average equity market over the past 100 years but may mean taking higher levels of risk and it’s not a figure that can be guaranteed.

Today, it’s more reasonable to expect annual pension returns of around 5%. Of course, a rate of investment return can never be guaranteed and while you’re saving into a pension you’ll likely experience peaks and troughs, as well as periods of volatility.

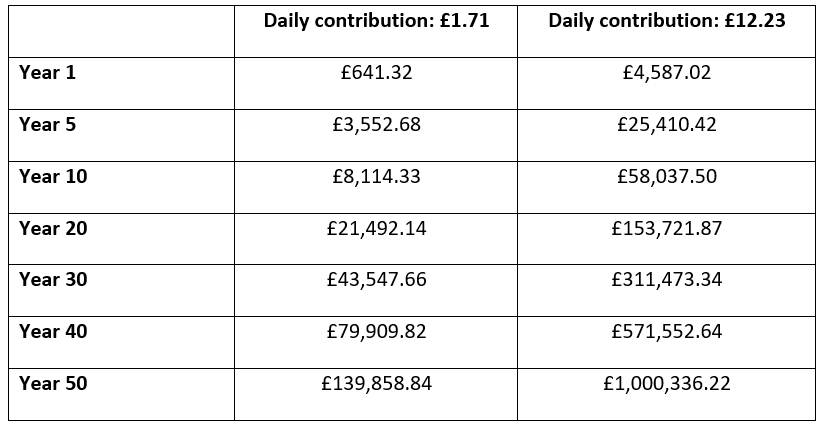

So, how could your pension contributions add up? The chart below gives you an idea of how pension investments and compounding can create security in retirement, assuming an annual return of 5%.

Source: The Calculator Site

Depositing £1.71 a day while receiving 5% returns means you fall significantly short of the £1 million goal, but you’d still make a hefty £108,652.84 return.

To reach that £1 million pension pot, you’d need to increase daily pension contributions to around £12.23, or £4,464 a year. That would mean putting £223,200 into your pension over your working life, but you’d received £777,136.22 in returns.

The sums needed to retire with £1 million can seem out of reach when you’re starting your career, but remember over your working life you can increase pension contributions as your salary increases. It’s not just compounding that helps your reach retirement goals either, tax relief and employer contributions can help too.

3 other reasons saving into a pension makes sense for young adults

- Your contributions will benefit from tax relief. Whether you make regular or a one-off pension contribution, it will receive an instant boost from tax relief. The amount of tax relief you receive will depend on which Income Tax band you’re in. If you’re a basic-rate taxpayer this will usually automatically be added to your pension. If you’re a higher- or additional-rate taxpayer, you can claim extra tax relief.

- Your employer will usually contribute on your behalf. Most workers are now automatically enrolled into a workplace pension. If you’re eligible, your employer must also contribute on your behalf, providing another boost to your retirement savings. However, if you opt out of your workplace pension, your employer doesn’t have to make contributions.

- Pensions are a tax-efficient way to invest. Your pension can grow free from Capital Gains Tax, making it an efficient way to invest for the long term.

While your pension won’t be accessible until your 55, rising to 57 in 2028, starting contributions early in your career means investments compounding, tax relief, and employer contributions can really add up to provide you with more security and freedom later in life.

If you’d like to discuss your pension and what it means for your retirement, please get in touch. Whether you’re still building up wealth or are nearing your retirement date, we can help.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.